Lusha is a popular choice for teams prospecting in Europe and leveraging LinkedIn, but when...

Read MoreLusha / Apollo.io: Which one to choose?

Compare Lusha and Apollo.io on various parameters including data depth, pricing, and integrations, and see why Zintlr is emerging as a smart, modern alternative.

Lusha vs Apollo.io: What to Know

n the fast-paced world of B2B sales, access to accurate data and the right toolset can define success. That’s why Lusha and Apollo.io frequently emerge as go-to platforms for sales teams seeking scale, speed, and precision.

Lusha leads with simplicity and trust. With a database of around 100M contacts, it emphasizes data accuracy, GDPR compliance, and user-friendly workflows making it ideal for teams focused on European markets and verified lead generation.

Apollo.io, in contrast, brings a robust all-in-one platform packed with 275M+ contacts, built-in outbound tools, intent data, and lead scoring. It’s a top pick for U.S.-focused teams aiming for high-volume prospecting but all that power comes with a steeper learning curve.

In this breakdown, we’ll explore Lusha vs Apollo.io across core dimensions like usability, data depth, compliance, and outbound automation, and highlight how newer players like Zintlr are carving out a balanced path between power and ease.

Let’s dive in and help you choose the platform that fits your team best.

Lusha vs Apollo.io:

Feature Comparison at a Glance

| Features | Lusha | Apollo.io |

|---|---|---|

| Contact Database Size | ~100M contacts (smaller), strong in European coverage | 275M+ contacts (large, global), particularly strong in U.S. coverage |

| Data Accuracy & Quality | Very high accuracy (~81% hit-rate), known for reliable direct dials. Focus on verified data and privacy compliance (GDPR) | Good accuracy (estimated ~75%) |

| Prospecting Tools | Basic – Primarily a contact finder. Offers essential filtering and a Chrome extension for LinkedIn, but no email sequencing or advanced outreach features. Focuses on quick lead lookup and export | Advanced – Includes sales engagement suite (email sequencing, templates, dialer), 65+ search filters |

| Integrations | Integrates with major CRMs (Salesforce, HubSpot, Pipedrive) and email providers . Provides an API as well, simpler integration setup | Native CRM integrations, and Zapier support, Robust API for custom integration |

| Compliance Status | GDPR & CCPA compliant | GDPR & CCPA compliant, ISO 27001 and SOC II certified |

| Best For | Smaller sales teams that need access to contact details and add-on features like email sequence automation | Start-ups and SMEs seeking an all-in-one platform for US prospecting |

Lusha delivers a plug-and-play contact finder with simplicity and highly accurate data especially for teams targeting Europe while Apollo offers a broader sales engagement platform with a larger, U.S.-focused database.

Market Presence & Data Strength

Europe

Lusha shines in European markets with its GDPR-first compliance and strong local data partnerships. It’s often preferred by sales teams prospecting across the EU, offering more accuracy and depth than Apollo in this region.

Apollo.io provides EU coverage, but users often report data inconsistencies in markets like Eastern Europe and the Middle East.

United States & Global Markets

Apollo.io dominates the U.S. market with over 275M+ contacts and integrated outreach tools—making it a favorite among startups and SMEs. Its free plan makes adoption easy, though its international accuracy can vary.

Lusha is growing in the U.S., but still lags behind Apollo and ZoomInfo in data volume and enrichment features.

India

Apollo.io sees traction in India, mainly because of its free tier. However, its mobile and direct dial coverage in the region is limited.

Lusha offers an easy-to-use platform with basic email and LinkedIn data, but its depth in the Indian market is shallow.

Neither platform is a clear leader in India, especially when it comes to verified mobile data or extensive B2B penetration.

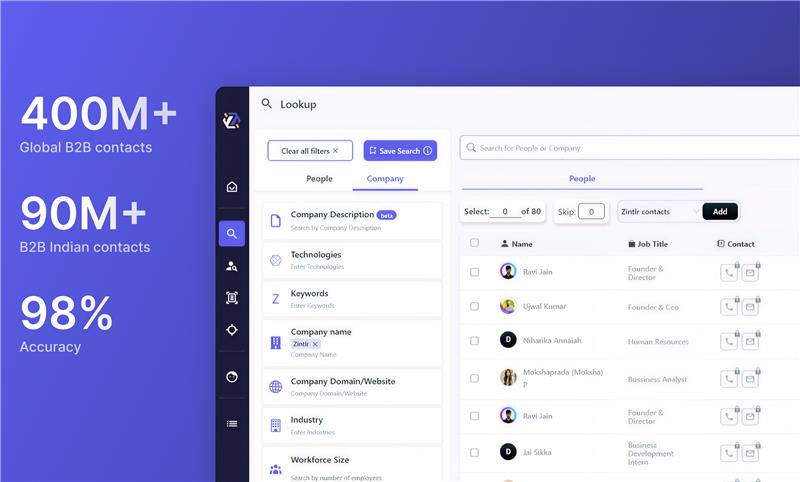

Zintlr's Data Coverage

Zintlr's Data Coverage

This is where platforms like Zintlr are closing the gap. Zintlr combines global reach with exceptional Indian market coverage, offering over 90M+ Indian contacts and 400M+ global records including direct mobile numbers, firmographics, and personality insights.

Unlike Apollo, which leans toward complex engagement tools, or Lusha, which focuses on simplicity, Zintlr strikes a balance providing deep, accurate data across regions while remaining easy to use and affordable. For teams selling into India, APAC regions or working across global markets, Zintlr often proves to be the more versatile alternative.

Lusha vs Apollo.io: Pricing Breakdown

Both Lusha and Apollo.io use a credit-based pricing model, which is now standard across most B2B data platforms.

Lusha’s pricing starts at just $29.90/month for the Pro plan and can go up to $747.50/month for the Premium tier, depending on the number of credits. What sets Lusha apart is its credit rollover feature on monthly plans—ensuring users don’t lose value if their outreach fluctuates. This makes Lusha a cost-effective and flexible option, especially for small to mid-sized teams.

Apollo.io, on the other hand, offers structured monthly plans starting at $59 for Basic and going up to $149 for Organization. While it packs in features like advanced filters, dialers, and lead scoring, these are often reserved for higher-tier plans. A key drawback is that unused credits don’t roll over, and pricing scales per user—potentially increasing the total cost for larger teams.

For the most accurate and updated pricing, visit the official Lusha Pricing and Apollo.io Pricing pages.

Zintlr's Pricing: Flexible, Transparent, and Built for Modern Teams

If you’re looking for a platform that bridges the gap offering deep B2B data (including mobile numbers), flexible pricing, and strong market coverage across the globe and in regions like India Zintlr is emerging as a smart alternative to both. With a growing user base and a focus on data quality, affordability, and usability, Zintlr brings together the best of both worlds for modern prospecting teams.

Compliance & Data Privacy

Apollo.io, while compliant with standard data regulations, has historically focused more on scale and functionality than strict privacy positioning. It offers basic data usage disclosures and maintains GDPR-aligned practices, but lacks the depth of certification and compliance transparency that Lusha provides. This makes Apollo a better fit for markets with less stringent data privacy environments, like the U.S.

Lusha places a strong emphasis on GDPR & CCPA compliance and privacy-first practices, holding certifications like ISO 27701 and the ePrivacy seal, which makes it particularly appealing for teams operating in or targeting European markets. Its commitment to compliance is reflected in its data sourcing and user controls, giving customers more confidence in privacy-sensitive regions.

Zintlr is Compliant to Data Security and Privacy

Rest assured knowing that our data collection practices prioritize compliance, providing you with the most reliable and secure business data. Our stringent data privacy and security protocols are in place for your peace of mind.

Curious how Zintlr stacks up against Lusha and Apollo.io?

Zintlr vs Apollo.io

Zintlr and Apollo.io are both powerful tools for B2B prospecting, but they cater to different...

Read MoreStill comparing tools? Why not try Zintlr free?

Advanced prospecting starts here, tap into 400M+ global leads.